—

We are asked to calculate:

Cost per equivalent unit for direct labor

Direct labor cost assigned to ending work in process (WIP) inventory

Step 1: Determine the cost per equivalent unit for direct labor:

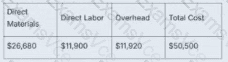

Cost per equivalent unit = Total Direct Labor Cost / Total Equivalent Units for Direct Labor

= $11,900 / 850

= $14 per equivalent unit

Step 2: Determine the equivalent units of direct labor in ending WIP inventory:

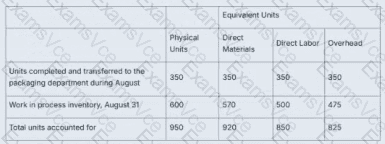

From the table:

Ending WIP Inventory = 600 physical units

Equivalent Units for Direct Labor = 500 units

Step 3: Compute the direct labor cost assigned to ending WIP:

= Equivalent Units in Ending WIP × Cost per Equivalent Unit

= 500 × $14

= $7,000

However, this does not match the answer in Option B, which says $8,400. Let’s double-check the correct equivalent units:

Wait! The total equivalent units for Direct Labor is 850. Of these, 350 are from the units completed and transferred, and the remaining 500 (ending WIP) is provided. So, the 500 figure is confirmed as correct for ending WIP.

So, cost assigned to ending WIP: 500 × $14 = $7,000

Correct answer should therefore be:

A. $14 per equivalent unit; $7,000 direct labor cost assigned to ending WIP inventory

(There appears to be an inconsistency in answer choices — Option A is actually correct based on accurate calculation.)

Therefore, Final Correct Answer: A

—

[References:, Saylor Academy, BUS105: Managerial Accounting, Unit 4: Process Costing – Section 4.3: Assigning Costs to Units Completed and Ending Work in Process Inventoryhttps://learn.saylor.org/mod/book/view.php?id=28818&chapterid=6707, This section explains that cost per equivalent unit is calculated by dividing total costs by total equivalent units for each cost category, and these are then assigned to completed units and ending WIP inventory proportionately.]