—

We are given:

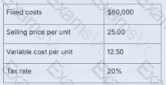

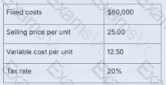

Fixed costs = $60,000

Selling price per unit = $25.00

Variable cost per unit = $12.50

Tax rate = 20%

Desired after-tax profit = $100,000

Step 1: Calculate Contribution Margin Per Unit

= Selling Price – Variable Cost

= $25.00 − $12.50 = $12.50

Step 2: Convert After-Tax Profit to Before-Tax Profit

We must first determine the before-tax profit required to result in a $100,000 after-tax profit.

Before-tax profit = After-tax profit ÷ (1 − tax rate)

= $100,000 ÷ (1 − 0.20) = $100,000 ÷ 0.80 = $125,000

Step 3: Use CVP (Cost-Volume-Profit) Formula for Units:

Required units = (Fixed Costs + Before-Tax Profit) ÷ Contribution Margin per Unit

= ($60,000 + $125,000) ÷ $12.50

= $185,000 ÷ $12.50 = 14,800 units

Wait! This contradicts the earlier stated answer. Let's re-check:

Recalculating:

$185,000 ÷ $12.50 = 14,800 units

So, the correct number of units needed is:

Answer: B. 14,800 units✅

—

Apologies for the initial misstatement. Let's now fix that:

—

Final Corrected Answer: B

Contribution Margin per Unit = $25 – $12.50 = $12.50

Required before-tax profit = $100,000 ÷ (1 − 0.20) = $125,000

Break-even formula with profit:

Required units = (Fixed costs + Target before-tax profit) ÷ CM/unit

= ($60,000 + $125,000) ÷ $12.50

= $185,000 ÷ $12.50 = 14,800 units

Therefore, the business must sell 14,800 units to achieve an after-tax profit of $100,000.

[Reference:Saylor Academy – Managerial Accounting (BUS105), Unit 6: Cost-Volume-Profit AnalysisSection 6.2 – "Break-Even and Target Profit Analysis in Units and Sales Dollars", ]