—

To assess the performance of division managers fairly, companies must evaluate performance in terms of relative efficiency—not absolute dollar amounts—especially when the divisions vary significantly in size, scope, or sales volume.

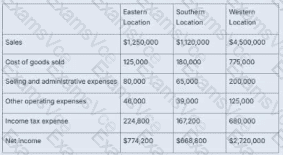

From the data:

Western location has the highest sales ($4,500,000) and highest net income ($2,720,000).

Eastern and Southern have significantly lower sales and net incomes.

While net income is a useful figure, it can be misleading in isolation when comparing divisions of unequal size. A larger division will naturally generate more profit, not necessarily due to better management, but simply due to scale.

To fairly compare performance, we should use measures like:

Return on Sales (ROS)

Profit Margin

ROI (Return on Investment)

Controllable Margin or Segment Margin

For example:

Western ROS = Net Income / Sales = 2,720,000 / 4,500,000 ≈ 60.4%

Eastern ROS = 774,200 / 1,250,000 ≈ 61.9%

Southern ROS = 668,800 / 1,120,000 ≈ 59.7%

→ Eastern actually has the highest profitability ratio.

Thus, using absolute net income alone would unfairly favor the Western location’s manager. It’s important to normalize the data across divisions of different size.

This aligns with Managerial Accounting best practices.

[Reference:Saylor Academy, BUS105: Managerial AccountingUnit 11.2 – Measuring and Evaluating Performancehttps://learn.saylor.org/mod/book/view.php?id=28830&chapterid=6743, “Comparisons across divisions must take into account differences in size and scale. Using return on investment or other standardized performance metrics allows for fair comparisons.”, —, Final Answer: DBecause the western location is larger, it would be unfair to use segmented net income as a measure for comparing each manager’s performance., ]