When two insurers cover the same property but the policies arenot subject to contribution, this means the insurance contracts are written so that each insurer is liable as if no other insurance exists. In effect, the insured may claim the full loss amount from either insurer, regardless of the proportional limits written on each policy.

This distinguishes the situation from typical concurrent insurance, where losses are shared proportionally. Because contribution doesnotapply here, the insured has full freedom to choose which insurer will pay the claim, up to the policy limit.

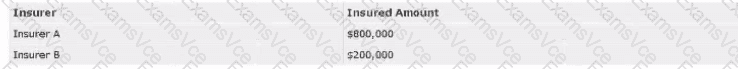

In this scenario:

The loss is $450,000.

Insurer A’s limit is $800,000, enough to pay the full claim.

Insurer B’s limit is $200,000 — insufficient to cover the entire loss.

Since contribution does not apply, the insured can claim the entire $450,000 from Insurer A without involving Insurer B. Insurer A cannot require the insured to claim part of the loss from Insurer B, nor can the insured demand that B pay part unless they choose to claim from B.

Option B is incorrect because proportional sharing only applies when contribution is explicitly activated.

Option C is incorrect because Insurer B does not owe anything unless the insured submits a claim to them.

Option D is incorrect because subrogation applies after paying a claim—B cannot pay and then pursue A, since A is not legally responsible for B’s voluntary payment.

Thus, the only correct choice is A.