AIWMI CCRA-L2 Question Answer

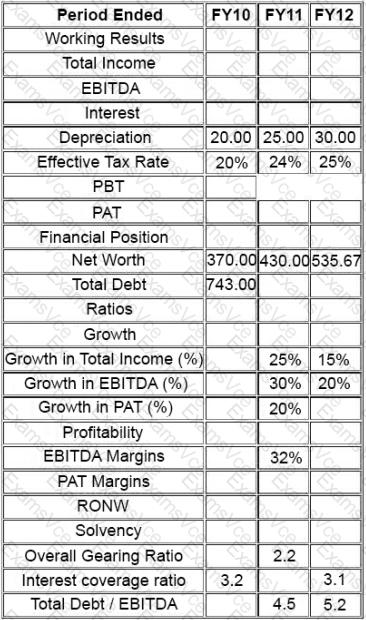

Ms. Mary Brown is a credit rating analyst. She had prepared a detailed report on one of her client, FlyHigh

Airlines Ltd, a company operating chartered aircrafts in India. As she was heading for a meeting with her superior on the matter, coffee spilled over her set of prepared paper(s). As she was getting late for meeting, instead of preparing entire set she could recollect few numbers from her memory and reconstructed following partial financial table:

An analyst comparing two competitors Comp Systems and Big Tables gathers the data below:

Cash Conversions Cycle:

Comp Systems: 18 days and Big Tables 32 days

Defense Interval Ratio:

Comp Systems: 50 and Big Tables: 20

What can the analyst conclude regarding the liquidity of these companies?

AIWMI CCRA-L2 Summary

- Vendor: AIWMI

- Product: CCRA-L2

- Update on: Feb 21, 2026

- Questions: 84