AFP CTP Question Answer

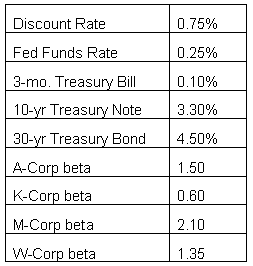

The historic rate of return in the U.S. stock market is 8%. An investment portfolio has a mix of equity investments consisting of 40% A-Corp stock, 30% K-Corp stock, 10% M-Corp stock and 20% W-Corp stock. The investment portfolio manager tends to buy and hold the equity investment position for 3 years on average. To calculate the required rate of return for this investment portfolio,

what rate from the table would be used as the risk-free rate?

AFP CTP Summary

- Vendor: AFP

- Product: CTP

- Update on: Feb 7, 2026

- Questions: 1076