AAFM CWM_LEVEL_2 Question Answer

Section B (2 Mark)

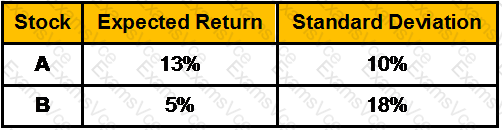

The expected returns and standard deviations of stock A and B are:

Manish buys Rs.20000 stock A and sells short Rs.10000 of stock B, using all the proceeds to buy more of stock A. The correlation between the two securities is 0.25. What are the expected return and the standard deviation of Manish’s portfolio?

AAFM CWM_LEVEL_2 Summary

- Vendor: AAFM

- Product: CWM_LEVEL_2

- Update on: Feb 7, 2026

- Questions: 1259