AAFM CWM_LEVEL_2 Question Answer

Section C (4 Mark)

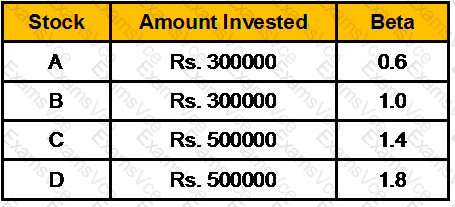

A Portfolio manager is holding the following portfolio:

The risk free rate of return is 6% and the portfolio’s required rate of return is 12.5%. The manager would like to sell all of his holdings in stock A and use the proceeds to purchase more shares of stock D. What would be the portfolio’s required rate of return following this change?

AAFM CWM_LEVEL_2 Summary

- Vendor: AAFM

- Product: CWM_LEVEL_2

- Update on: Feb 7, 2026

- Questions: 1259