AAFM CWM_LEVEL_2 Question Answer

Section C (4 Mark)

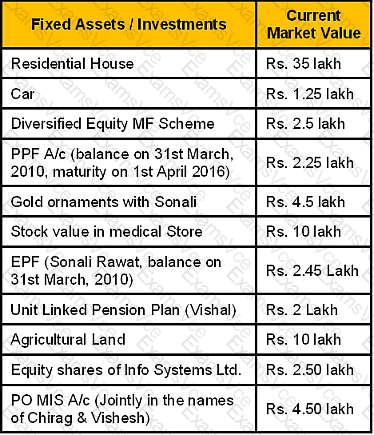

Harish Rawat has approached you on 26th Nov 2010, a Chartered Wealth Manager, for preparing a comprehensive Wealth plan to accomplish his financial goals. From your initial meeting, you have gathered the following information:

Harish Rawat, aged 44 years with life expectancy 70 years, is self-employed in Dehradun. Harish’s wife Sonali, aged 41 years with life expectancy 72 years, is working as a Assistant Manager in a Telecom

Company and is having a post-tax income of Rs. 4 lakh p.a. She is expected to retire at the age of 55 years. The couple has two children Chirag, aged 16 years and Vishesh, aged 10 years. Chirag is studying in 10th standard while Vishesh is studying in 4th standard. Harish’s net annual Income from retail medical store is Rs. 8 Lakh and their monthly household/living expenses, excluding housing loan EMI, are Rs. 32,500.

Harish is a Graduate. He earlier served in a pharmaceutical company as a medical representative for approx. 10 years. After separation from the company, he started his own wholesale business of medicines but could not sustain for long due to lack of working capital. He shut down his operations after 3.5 years. Thereafter he got a contract for retail medical shop in the premises of a nursing home. The terms of the contact are profit sharing in the ratio 50:50. Investment in stock and handling all activities of medical store are of Harish and no rent is charged by the owner of nursing home.

Harish had taken a housing loan of Rs. 15 Lakh disbursed on 1st April 2005. They are presently paying an EMI of Rs. 17,285 at the end of every month beginning from the month of disbursement. The loan is at fixed rate of interest of 11.25% p.a. (reducing monthly balance basis) with tenure of 15 years. Harish has taken a money back insurance plan of 20 year term with sum assured of Rs. 6 Lakh, the annual premium being Rs. 26,250. He has paid 14 annual premiums till date regularly. The policy provides for 20% of the basic sum assured to the insured as survival benefit after 4th, 8th, 12th, 16th years from the start of the policy. He has also taken a Mediclaim family floater policy which covers his spouse and two sons to the extent of Rs. 5 Lakh. He has also paid four regular annual premiums of Rs. 36,000 in a unit linked pension plan and next premium is due on 1st Dec 2010.

Harish’s parents are senior citizens and live in their own house in Haldwani District. Their only source of income is by way of interest received from their joint Senior Citizen Savings Scheme account. Harish’s younger brother, who is also self-employed, is living with his parents.

Harish had invested Rs. 1 lakh to buy 200 shares of a listed company, Mobizox, in the year 2001-02. The Company had issued Bonus shares in the ratio 1:1 in the year 2005-06.Harish also subscribed to the Company’s Rights issue of one share for every four shares held at a price of Rs. 250 per share in Feb 2010. Harish also invested Rs. 4 lakh in an Agriculture land at his native village in Haldwani in 2000-01.

Goals and aspirations

1.To make provision for their children’s higher education expenses at their respective age of 21 years.

2.Such expenses are Rs. 5 lakh for each child at current prices.

3.To make provision for children’s marriage expected at the end of 10 years and 15years from now; presently valued at Rs. 5 lakh each.

4.Build a corpus for his retirement at the age of 58 years

5.To go on vacation with family in January, 2011

Assumptions

1.Inflation is currently 6% p.a. and is likely to remain the same.

2.Risk free interest rate is at 7% p.a.

3.Return on equity MF is 12% p.a.

4.Return on debt MF is 8% p.a.

5.Cost Inflation index is 281 for 1995-96, is 406 for 2000-01, is 463 for 2003-04, is 551for 2007-08, is 582 for 2008-09 and is 632 for 2009-10.

AAFM CWM_LEVEL_2 Summary

- Vendor: AAFM

- Product: CWM_LEVEL_2

- Update on: Feb 7, 2026

- Questions: 1259