AAFM CWM_LEVEL_2 Question Answer

Section C (4 Mark)

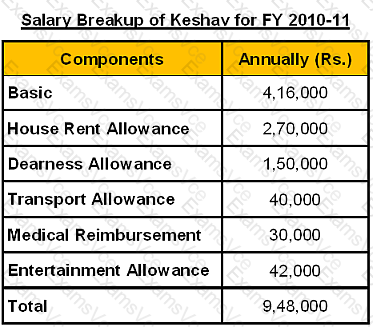

Keshav and Deepti Gohlyan approached you a Chartered Wealth Manager for preparing a Wealth plan to achieve their financial goals. Keshav Gohlyan, aged 45 years, is working in Chennai in an MNC, at a managerial level. His wife Deepti, aged 42 years, is working in a Private Company and has a post-tax income of Rs. 4 lakh p.a. She is expected to retire at the age of 55 years. Keshav’s gross salary is likely to grow at 7% p.a. and Deepti's gross salary is likely to grow at 6% p.a. The couple has two children – daughter Yogita, aged 18 years, pursuing her Graduation in Economics, and son Navneet, aged 16 years, studying in 12th standard. Navneet intends to become a Doctor.

Keshav's monthly household expenses are Rs. 40,000 out of which Rs. 8,000 is of Keshav’s personal expenses, this excludes EMI on loans and Insurance premiums. Keshav has two siblings Keshav and his family stay with his mother. His father passed away due to severe heart attack on 15-Dec-2009, at the age of 75 years, leaving a house (Value on 15thDec 2009 Rs. 25 lakh) in which they are currently staying.

Keshav has a term insurance of Rs. 20 lakh (for 20 years); the term expires 5 years from now. Both are covered under Group Medical Insurance for Rs. 4 Lakh family floater each provided by their respective employers

Assets

The couple’s assets as on 31-3-2010 are;

1.Cash in Hand Rs. 10,000

2.Bank balance Rs. 50,000

3.Diversified Equity Mutual Fund units at market value Rs. 2.60 lakh

4.Equity Shares at market value Rs. 15.25 lakh

5.Debt oriented Mutual Fund units at market value Rs. 1.65 lakh

6.PPF A/c balance Rs. 4.25 lakh (Keshav), Rs. 3.15 lakh (Deepti), both maturing on1st April 2016

7.ELSS Mutual Fund units at market value Rs. 75,000

8.A separate house is in the joint name of Keshav and Deepti with 50% ownership of each. This house has two floors and is let out for rent of Rs. 8,000 p.m. each floor.

Present Market Value of this House is Rs. 70 Lakh1

9.Gold Ornaments at market value Rs. 6.35 lakh

10.Car at market value Rs. 2.60 lakh

11.300 Gold ETF units purchased on 17th Oct 2006 @ 983 per unit

12.National Saving Certificates invested amount Rs. 4 lakh

13.Money back insurance plan of 20 year term with sum assured of Rs. 5 Lakh2

14.Unit linked insurance plan of 10 years with sum assured of Rs. 5 lakh3

____________________

1.Keshav and Deepti had jointly taken a housing loan of Rs. 30 Lakh to purchase the house costing Rs. 37.50 Lakh on 1st April 2003. The pay an EMI of Rs. 16,349 each, EMI date being last day of the month. The loan is for 15 years at a fixed rate of interest of 10.25%p.a.

2.Annual premium of Rs. 23,750. Paid 16 annual premiums till date before due date. The policy provides 25% of basic sum assured to insured as survival benefit after 5th, 10th, 15thyears from the start of the policy.

3.Annual premium of Rs. 35,000 p.a.

Liabilities

Housing loan outstanding: Rs. 21.36 Lakh

Goals & Aspirations:-

1.Plan for Navneet’s medical education expenses which is likely to be Rs. 3.50 lakh at theend of one year from now and increasing thereafter at 8%p.a. during the next 4years.

2.Plan for Yogita’s goal of Post-Graduation degree from abroad which is likely to cost Rs. 10 lakh in present terms required after three years.

3.Create a separate fund to provide every year post-retirement till his lifetime, vacation expenses amounting to Rs. 50,000 in current terms, such expenses increasing at the rate of 7% p.a.

4.To accumulate funds for marriage of Navneet and Yogita. For Navneet they will require in present terms Rs. 10 lakh when he attains 26 years and for Yogita he would require Rs. 15 lakh when she attains 25 years.

5.Build a retirement corpus for expenses in his post-retirement period at 75% of pre-retirement expenses at the retirement age of 60 years

Life Expectancy

Keshav: 80 years

Deepti: 78 years

Assumptions regarding long-term pre-tax returns on various asset classes:

1.Equity & Equity MF schemes/ Index ETFs11.00% p.a.

2.Balanced MF schemes9.00% p.a.

3.Bonds/Govt. Securities/Debt MF schemes7.00% p.a.

4.Liquid MF schemes5.50% p.a.

5.Gold & Gold ETF7.50% p.a.

Assumptions regarding economic factors:

1.Inflation: 5.50% p.a.

2.Expected return in Risk free instruments: 6.50% p.a.

3.Real Estate appreciation: 8.00% p.a

Cost Inflation Index

AAFM CWM_LEVEL_2 Summary

- Vendor: AAFM

- Product: CWM_LEVEL_2

- Update on: Feb 7, 2026

- Questions: 1259