AAFM CWM_LEVEL_2 Question Answer

Section C (4 Mark)

Two friends Neeraj and Kapil, both belonging to the 33.66% tax bracket, have invested Rs. 10 lakhs in a debt-based scheme. The scheme is a regular run of the mill, assembly line product — nothing extraordinary about it.

The scheme has earned a distributable profit of 12%.

Kapil’s financial condition is not good and due to the business losses his assets are to be auctioned.

Neeraj is working in MNC and getting an annual package of Rs. 18 lakhs. This includes Rs. 270000 as dearness allowance (2/3 forms the part of retirement benefit). He is also earning an agricultural income of Rs. 54000.His expenses are Rs. 80000 per month.

Neeraj has also taken a housing loan in joint name of his wife Anita and himself. Property is also in the joint name and their contribution is equal. Annual outflow towards housing loan in terms of repayment of principal and interest is Rs. 300000. Out of this Rs. 198800 is toward interest.

Neeraj has also invested an equal amount in a portfolio consisting of securities A and B. Standard deviation of A is 12.43%; Standard deviation of B is 16.54%; Correlation coefficient is 0.82

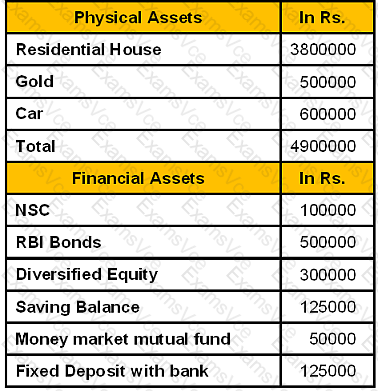

Assets held by Neeraj

AAFM CWM_LEVEL_2 Summary

- Vendor: AAFM

- Product: CWM_LEVEL_2

- Update on: Feb 7, 2026

- Questions: 1259