AAFM CWM_LEVEL_2 Question Answer

Section C (4 Mark)

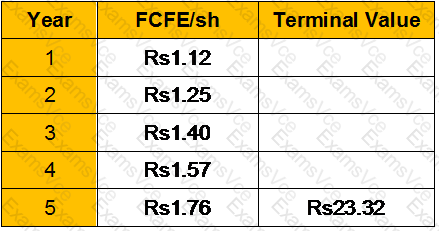

Watts Industries, a manufacturer of valves for industrial and residential use, had the following projected free cash flows to equity per share for the next five years , in nominal terms.

The terminal price is based upon a stable nominal growth rate of 6% a year after year 5. The discount rate, based upon financial market rates, is 14%, and the expected inflation rate is 3%.

Estimate the value per share, using nominal cash flows and the nominal discount rate.

AAFM CWM_LEVEL_2 Summary

- Vendor: AAFM

- Product: CWM_LEVEL_2

- Update on: Feb 7, 2026

- Questions: 1259