CIMA F1 Question Answer

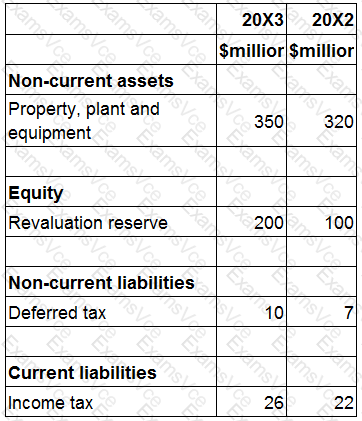

The following information is extracted from the statement of financial position for ZZ at 31 March 20X3:

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is $28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What cash outflow figure should be included within cash flows from investing activities for the purchase of property, plant and equipment?

CIMA F1 Summary

- Vendor: CIMA

- Product: F1

- Update on: Mar 13, 2026

- Questions: 248