CIMA F3 Question Answer

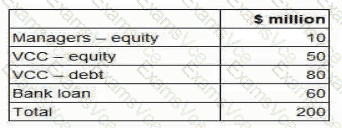

A company intends to sell one of its business units. Company W, by a management buyout (MBO). A selling price of S200 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal.

The VCC requires a minimum return on its equity investment In the MBO of 35% a year on a compound basis over 5 years. What is the minimum total equity value of Company W in 5 years time in order to meet the VCC's required return? Give your answer to one decimal place.

CIMA F3 Summary

- Vendor: CIMA

- Product: F3

- Update on: Dec 26, 2025

- Questions: 393