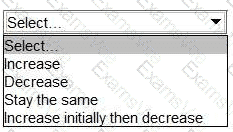

Increase initially then decrease

This question tests understanding of the traditional theory of capital structure, a core topic within CIMA F3 under Cost of Capital and Capital Structure. The traditional view differs from Modigliani and Miller by arguing that there is an optimal capital structure where a company’s Weighted Average Cost of Capital (WACC) is minimised.

According to traditional theory, at low levels of gearing, introducing debt into the capital structure reduces WACC. This occurs because debt is generally cheaper than equity, largely due to lower risk for lenders and the tax deductibility of interest payments. Initially, equity holders do not perceive a significant increase in financial risk, so the cost of equity remains relatively stable. As a result, replacing some equity with cheaper debt lowers the overall WACC.

However, as gearing continues to rise beyond a certain point, the financial risk borne by both debt holders and equity holders increases substantially. Lenders demand higher interest rates to compensate for increased default risk, and shareholders require a higher return due to greater earnings volatility. This leads to rising costs of both debt and equity. Beyond the optimal gearing level, these rising costs outweigh the benefits of cheaper debt, causing WACC to increase.

CIMA F3 study guidance therefore concludes that under traditional theory, WACC:

Falls initially as gearing increases, and

Rises after the optimal capital structure is exceeded.

Since the directors are increasing gearing toward an industry average, the most appropriate description of WACC behaviour under traditional theory is that it will decrease initially and then increase.