CIMA F3 Question Answer

BBA is a wholly owned subsidiary of AAB BBA operates in country B where the currency is the B$.

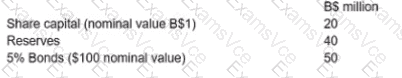

The following is an extract from BBA's financial statements at 31 December 20X1:

The following Information is relevant:

" The bonds were trading at $110 per $100 on 31 December 20X1. "Operating profit of BBA for the year ended 31 December 20X1 was S15 million

• The P/E ratio is 8

* Corporate income tax rate is 20%.

The tax authorities m country B Implemented thin capitalisation rules based on the level of gearing of the subsidiary, calculated as book value o( debt lo book value of equity The cut-off point for gearing used by the tax authorities for a company to be thinly capitalised is 75%.

Which of the following statements is correct as at 31 December 20X1?

CIMA F3 Summary

- Vendor: CIMA

- Product: F3

- Update on: Dec 25, 2025

- Questions: 393