CIMA F3 Question Answer

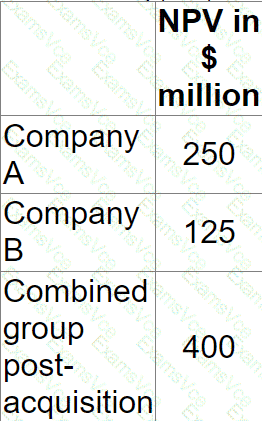

Company A is planning to acquire Company B by means of a cash offer. The directors of Company B are prepared to recommend acceptance if a bid price can be agreed. Estimates of the net present value (NPV) of future cash flows for the two companies and the combined group post acquisition have been prepared by Company A’s accountant. There are as follows:

What is the maximum price that Company A should offer for the shares in Company B?

Give your answer to the nearest $ million

CIMA F3 Summary

- Vendor: CIMA

- Product: F3

- Update on: Feb 7, 2026

- Questions: 393