CIMA F3 Question Answer

Company BBB has prepared a valuation of a competitor company, Company BBD. Company BBB is intending to acquire a controlling interest in the equity of Company BBD and therefore wants to value only the equity of Company BBD.

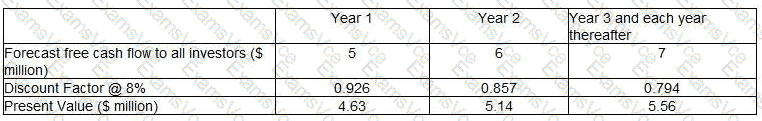

The directors of Company BBB have prepared the following valuation of Company BBD:

Value of Equity = 4.63 + 5.14 + 5.56 = S15.33 million

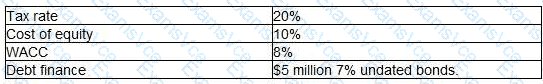

Additional information on Company BBD:

Which THREE of the following are weaknesses of the above valuation?

CIMA F3 Summary

- Vendor: CIMA

- Product: F3

- Update on: Feb 7, 2026

- Questions: 393