CIMA F3 Question Answer

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

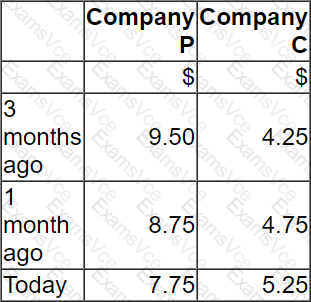

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

CIMA F3 Summary

- Vendor: CIMA

- Product: F3

- Update on: Dec 29, 2025

- Questions: 393