CIMA F3 Question Answer

The two founding directors of an unlisted geared company want to establish its value as they are intending to approach a venture capitalist for additional funding.

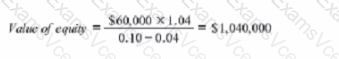

The funding will be used to invest in a major new project which has very high growth potential. The directors intend to sell 10% of the company to the venture capitalist They have prepared the following current valuation of the company using the divided valuation model:

The following information is relevant.

• $60,000 is the most recent dividend paid.

• 4% is the average dividend growth over the last few years.

• 10% is an estimate of the company's cost of equity using the CAPM model with the industry average asset beta

Which THREE of the following are weaknesses of the valuation method used in these circumstances?

CIMA F3 Summary

- Vendor: CIMA

- Product: F3

- Update on: Jan 11, 2026

- Questions: 393