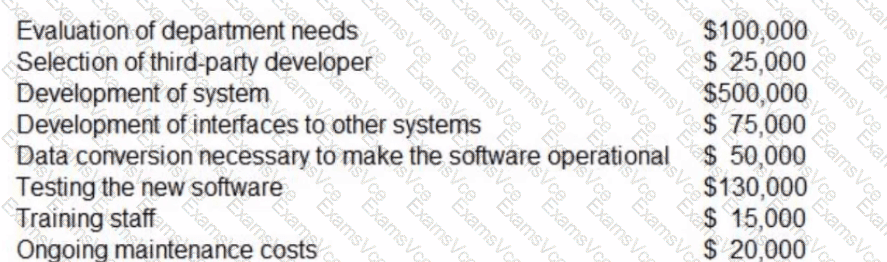

According to GASB Statement No. 51 (Accounting and Financial Reporting for Intangible Assets), only costs incurred during the “application development stage” are capitalized for internally generated software. These include:

✔Development of the system – $500,000

✔Development of interfaces – $75,000

✔Data conversion necessary to make software operational – $50,000

✔Testing the software – $130,000

Excluded (should be expensed):

✘Evaluation of needs (preliminary) – $100,000

✘Selection of developer – $25,000

✘Staff training – $15,000

✘Ongoing maintenance – $20,000

Total Capitalizable Costs:

$500,000 + $75,000 + $50,000 + $130,000 = $755,000

Relevant References:

GASB Statement No. 51 – Paragraphs 6–12

GFOA Guidelines – Capitalization of Intangible Assets

Answer: C. $755,000