We calculate straight-line depreciation for each asset using the formula:

Depreciation = Cost ÷ Useful Life

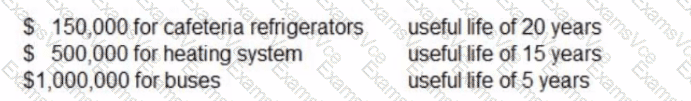

Given:

Refrigerators: $150,000 ÷ 20 = $7,500

Heating system: $500,000 ÷ 15 = $33,333.33

Buses: $1,000,000 ÷ 5 = $200,000

Total Depreciation:

$7,500 (Refrigerators)

$33,333.33 (Heating system)

$200,000 (Buses)

= $240,833.33

So the correct depreciation expense (rounded to the nearest dollar) is:

Answer: D. $240,833

Note: Option B ($207,500) is incorrect because it does not reflect total depreciation based on the useful lives provided.

Relevant References:

GASB Statement No. 34 – Capital Asset Reporting

GFOA Best Practices – Capital Assets and Depreciation

FASAB SFFAS No. 6 – Accounting for Property, Plant, and Equipment

Answer: D. $240,833

What is the depreciation expense for the current year?

What is the depreciation expense for the current year?