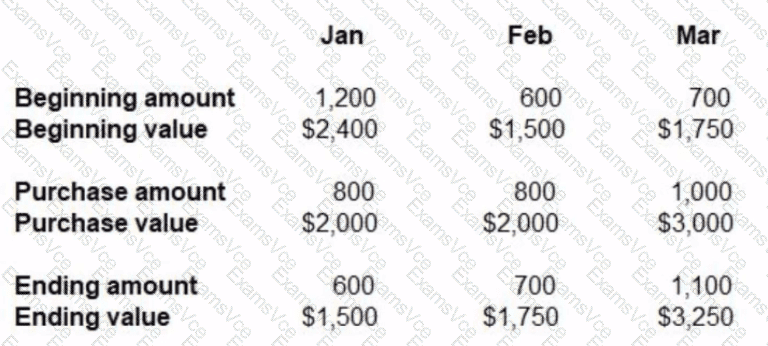

The organization’s inventory records show that the beginning and ending amounts and values change each month, and the relationship between units and dollar values suggests that the cost per unit is averaged, not fixed (as with FIFO or LIFO). Let’s evaluate January:

Beginning: 1,200 units / $2,400 → $2.00 per unit

Purchased: 800 units / $2,000 → $2.50 per unit

Ending: 600 units / $1,500 → $2.50 per unit

The ending value of $1,500 for 600 units gives a per-unit cost of $2.50, matching the purchase cost in January. This suggests the system uses a weighted average cost method rather than tracking the specific cost layers (as FIFO or LIFO would).

Relevant References:

FASAB SFFAS No. 3 – Accounting for Inventory and Related Property

GAAP and GASB guidelines on inventory valuation

GFOA Best Practices – Inventory and Supply Chain Management

Answer: B. average cost