AAFM GLO_CWM_LVL_1 Question Answer

Consider the following information for three stocks, Stock A, Stock B, and Stock C. The returns on each of the three stocks are positively correlated, but they are not perfectly correlated.

Portfolio X has half of its funds invested in Stock A and half invested in Stock B. Portfolio Y has invested its funds equally in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium.

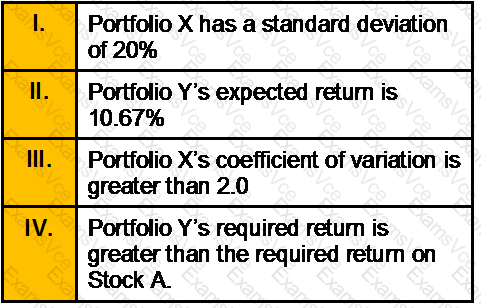

Which of the following statements is/are correct?

AAFM GLO_CWM_LVL_1 Summary

- Vendor: AAFM

- Product: GLO_CWM_LVL_1

- Update on: Feb 7, 2026

- Questions: 1057