AAFM GLO_CWM_LVL_1 Question Answer

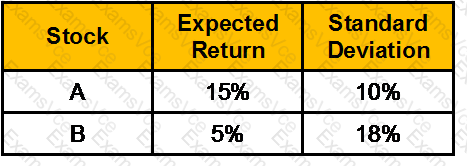

The expected return and standard deviations of stock A & B are:

Amit buys Rs.20,000 of Stock A and sells short Rs.10,000 of Stock B using all the Proceeds to buy more or stock A. The correlation Between the two securities is. 35. What are the expected return & standard deviation of Amit’s portfolio?

AAFM GLO_CWM_LVL_1 Summary

- Vendor: AAFM

- Product: GLO_CWM_LVL_1

- Update on: Feb 7, 2026

- Questions: 1057