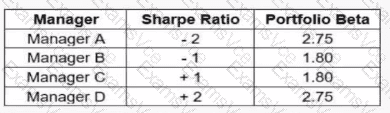

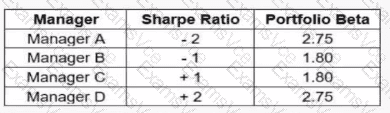

The correct answer is C. Manager D, because the Sharpe ratio is the primary measure used to evaluate risk-adjusted return, which is return earned per unit of total risk. The Investment Funds in Canada curriculum defines the Sharpe ratio as a tool that “measures how much excess return a portfolio generates relative to the risk taken.” A higher Sharpe ratio indicates superior risk-adjusted performance.

Manager D has the highest Sharpe ratio (+2) among all managers listed, meaning this manager generated the greatest excess return for each unit of risk, regardless of the portfolio’s beta. Although Manager D has a higher beta (2.75), beta measures systematic market risk, not total volatility. The Sharpe ratio already accounts for total risk (standard deviation), making it the preferred comparison metric when the question asks for return for a given level of risk.

Manager C has a positive Sharpe ratio (+1) but lower than Manager D, indicating inferior risk-adjusted performance. Managers A and B both have negative Sharpe ratios, which the CIFC text explains means the portfolio underperformed the risk-free rate, making them clearly inferior choices.

The CIFC curriculum stresses that when comparing managers across different risk profiles, “the Sharpe ratio is the most appropriate measure.” Since Manager D delivers the highest risk-adjusted return, Option C is the correct and fully CIFC-verified answer.