IFSE Institute LLQP Question Answer

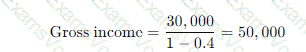

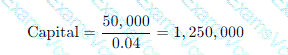

Oliver, an insurance agent, meets with Roman and Julie. They are a married couple with a five-year-old son William. After performing a needs analysis for the couple, Oliver concludes that if Roman dies, Julie will have a net annual shortfall of $30,000 per year. Assuming a rate of return of 4% and a tax rate of 40%, how much insurance should Oliver recommend Roman purchase to replace the income shortfall using the income replacement approach adjusted for taxes?

IFSE Institute LLQP Summary

- Vendor: IFSE Institute

- Product: LLQP

- Update on: Feb 3, 2026

- Questions: 328

A black and white math equation Description automatically generated with medium confidence

A black and white math equation Description automatically generated with medium confidence A number with numbers and lines Description automatically generated with medium confidence

A number with numbers and lines Description automatically generated with medium confidence