PRMIA 8006 Question Answer

Which of the following statements is true:

I. A high market beta implies a high degree of correlation with the market

II. Correlation coefficient and covariance between assets have the same sign

III. A correlation of zero indicates the absence of a linear relationship between the two assets

IV. Unless assets are perfectly correlated, diversification always reduces portfolio risk.

PRMIA 8006 Summary

- Vendor: PRMIA

- Product: 8006

- Update on: Feb 4, 2026

- Questions: 287

103.04.e2

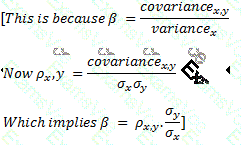

103.04.e2 103.04.e2, where x is the market portfolio and y is the asset under consideration.

103.04.e2, where x is the market portfolio and y is the asset under consideration. 103.04.e

103.04.e