PRMIA 8008 Question Answer

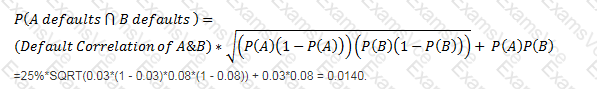

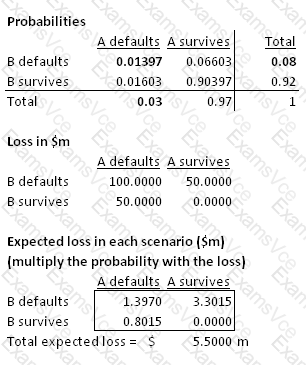

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon. If the default correlation is 25%, what is the one year expected loss on this portfolio?

PRMIA 8008 Summary

- Vendor: PRMIA

- Product: 8008

- Update on: Feb 4, 2026

- Questions: 362