PRMIA 8013 Question Answer

A portfolio manager desires a position of $10m in physical gold, but chooses to get the exposure using gold futures to conserve cash. The volatility of gold is 6% a month, while that of gold futures is 7% a month. The covariance of gold and gold futures is 0.00378 a month. How many gold contracts should he hold if each contract is worth $100k in gold?

PRMIA 8013 Summary

- Vendor: PRMIA

- Product: 8013

- Update on: Feb 4, 2026

- Questions: 287

103.11.e1 is the standard deviation of the asset to be hedged, and

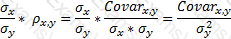

103.11.e1 is the standard deviation of the asset to be hedged, and  103.11.e2 is the standard deviation the asset being used to hedge against price movements in x, then the minimum variance hedge ratio is given by the expression

103.11.e2 is the standard deviation the asset being used to hedge against price movements in x, then the minimum variance hedge ratio is given by the expression  103.11.e3. In this question, correlation = 0.00378/(6%*7%) = 0.9. The minimum variance hedge ratio is given by (6%/7%)*0.9 = 0.77

103.11.e3. In this question, correlation = 0.00378/(6%*7%) = 0.9. The minimum variance hedge ratio is given by (6%/7%)*0.9 = 0.77 103.11.a3

103.11.a3