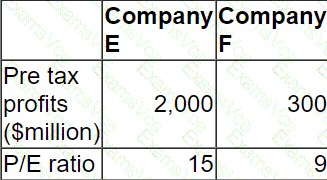

In CIMA F3, the valuation of a target in an acquisition using P/E multiples is based on the principle that the maximum price a bidder should pay is the value of the target to the bidder, i.e. the value of the target’s earnings when capitalised at the bidder’s P/E ratio if post-acquisition performance is expected to match the bidder’s. When tax is involved, the profits used must be after tax earnings, because the P/E ratio is defined as:

P/E=Market Value of EquityEarnings after tax\text{P/E} = \frac{\text{Market Value of Equity}}{\text{Earnings after tax}}P/E=Earnings after taxMarket Value of Equity

Step 1 – Convert pre-tax profit to earnings

Company F’s pre-tax profit = $300m.

Corporate tax rate = 30%.

EarningsF=300×(1−0.30)=300×0.70=$210m\text{Earnings}_F = 300 \times (1 - 0.30) = 300 \times 0.70 = \$210\text{m}EarningsF=300×(1−0.30)=300×0.70=$210m

Step 2 – Apply Company E’s P/E ratio (bootstrapping effect)

Because both firms have similar risk and E believes it can “bootstrap” F’s earnings so that the market values F on E’s P/E of 15:

Value of F to E=EarningsF×P/EE=210×15=$3,150m\text{Value of F to E} = \text{Earnings}_F \times \text{P/E}_E = 210 \times 15 = \$3,150\text{m}Value of F to E=EarningsF×P/EE=210×15=$3,150m

This represents the combined value of F’s earnings once integrated into E and re-rated at the higher multiple. Under F3 principles, this figure is the maximum price E should be willing to pay; paying more would destroy value for E’s shareholders because the purchase price would exceed the value created by the acquisition.

Therefore, the maximum offer price to F’s shareholders is:

$3,150 million\boxed{\$3,150\ \text{million}}$3,150 million