CIMA F3 Question Answer

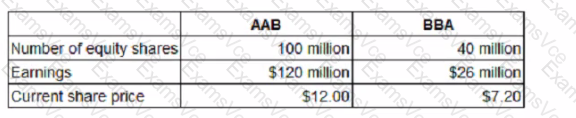

Company MB is in negotiations to acquire the entire share capital of Company BBA. Information about each company is as follows:

It is expected that Company BBA's profit before interest and tax will be $30 million in each of the two years after acquisition. Company AAB is considering how best to structure the offer Company AAB's discount factor and appropriate cost of equity for use in valuing Company BBA is 10%

Shareholders taxation implications should be ignored

Which of the following provides the shareholders of Company BBA with the highest offer price?

CIMA F3 Summary

- Vendor: CIMA

- Product: F3

- Update on: Jan 16, 2026

- Questions: 393