CIMA F3 Question Answer

Listed Company A has prepared a valuation of an unlisted company. Company B. to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

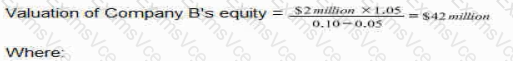

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

• S2 million is Company B's most recent dividend

• 5% is Company B's average dividend growth rate over the last 5 years

• 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?

CIMA F3 Summary

- Vendor: CIMA

- Product: F3

- Update on: Jan 15, 2026

- Questions: 393