CIMA G1 Question Answer

A few days later, you receive the following email:

From: Matt Spot, Finance Director

To: Financial Manager

Subject: outsourcing and accounting decisions

Hello

I have just come from a Board meeting and am pleased to tell you that the Board has approved plans for changing our ordering system as well as the menu.

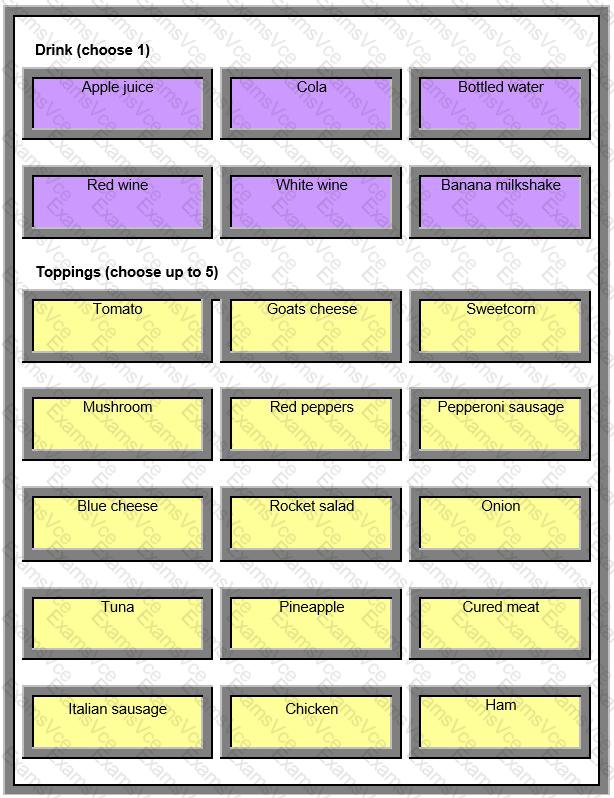

The plan is to install hi-tech devices so that customers can order their own food and drinks. Each restaurant table will be fitted with the devices. I have attached a suggested screen layout for you to look at. The coloured squares are all touch sensitive.

We are considering outsourcing to O-tech the installing, operating and updating of the software that runs the system. O-tech is a software house that specialises in such applications. We would pay an annual fee to O-tech to maintain and update the software in response to any changes that we make to prices or products. O-tech also install all software updates. Alternatively, we could buy a licence for the software and have it managed by our own IT staff.

We will purchase outright any hardware required, including the table top and associated network devices. The hardware has an expected useful life of five years, this will lead to a hefty depreciation charge and could depress management bonuses. The hardware supplier has offered to write a report that states that the life could be up to ten years and that we could justify depreciating the hardware over a longer period. If we show that report to our external auditor and charge the lower depreciation nobody will realise that we have understated depreciation until we have to replace the hardware after five years. We can claim to have made an honest mistake when that happens, if we are still working here then. Who knows? These devices might even last for ten years!

I need your ideas on:

Whether it is advisable to outsource the software to O-tech. Please explain the main factors that affect this decision.

The ethical issues that arise in relation to the proposal to depreciate the hardware over ten years.

Matt

CIMA G1 Summary

- Vendor: CIMA

- Product: G1

- Update on: Jan 7, 2026

- Questions: 20