CIMA G1 Question Answer

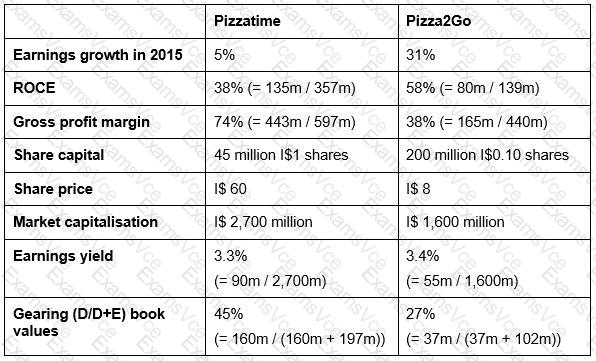

Comparative results for Pizzatime and Pizza2Go

You have received the following email:

From: Monica Lall, Chief Executive

To: Financial Manager

Subject: benchmarking and growth ideas

Hi,

As you will already be aware, in 2015 our annual growth in both earnings and revenue was well below the target of 10%. This has clearly been a disappointment to our shareholders and we need to take rapid action to rebuild market confidence and avoid a fall in our share price. I would value your input on this one.

You will also see, from the financial data in the attachment, that our competitor, Pizza2Go, has reported higher growth and also a higher ROCE and I need to be able to explain these figures to our analysts. It would be really helpful to understand what they mean in terms of shareholder returns. The earnings growth figures are particularly disappointing, especially as Pizza2Go has shown such strong growth.

I need a response to this email as soon as possible that:

• Analyses the financial data in the attachment and explains what the ROCE and earnings growth figures mean in terms of the relative success of the two companies and returns to shareholders. I notice that we have a much higher gross profit margin and approximately the same earnings yield. Is it possible that the ROCE and earnings growth figures are misleading and that we are actually performing better than Pizza2Go?

• Suggests ways in which we could improve profitability. Use Porter's value chain model as your base.

Regards

Monica Lall

Chief Executive

Pizzatime

CIMA G1 Summary

- Vendor: CIMA

- Product: G1

- Update on: Jan 7, 2026

- Questions: 20