CIMA G1 Question Answer

Extract from promotional pack addressed to potential franchisees

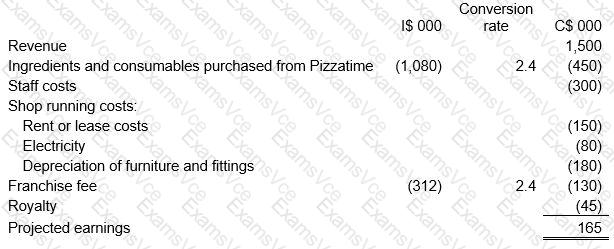

There is no real upper limit to the profits that you might earn as a Pizzatime franchisee. That depends on your hard work and commitment. We have prepared the following projected statement based on a typical franchise operation in I-land. We have adjusted those figures to reflect local circumstances in C-land where appropriate and have converted ongoing running costs that will be priced in I$ to C$ for your convenience.

Our projected annual figures for a typical C-land franchisee are as follows:

These estimates are based on a 'most likely' scenario. We have based the conversion of costs that will be priced in terms of I$ on the average rate that was in force throughout the year ended 31 December 2015.

With hard work and imagination, you could easily exceed these figures. Many successful franchisees in I-land have gone on to open several restaurants and are now very wealthy.

The sky is the limit with Pizzatime!

Six months have passed since your exchange of emails with the Finance Director. Pizzatime has commenced its venture into the C-land market, but very few franchise agreements have been signed.

The Finance Director has asked you into his office

"We have signed fewer than half the franchise agreements that we had planned to have completed by now. Paradoxically, business people in C-land are complaining that the agreement looks very attractive at present because the C-land economy is strong and the C$ is at an all-time high. They are concerned that it will be a different story in the long term when the C$ weakens.

I have sent you a copy of the document we include in the proposal pack that we send out to interested applicants. We sent a copy to a potential franchisee and she complained that it was too simplistic and ignored changes in key variables such as fluctuating exchange rates.

Dennis Chan has asked me to consider acquiring a small logistics company in C-land and using it to import ingredients and consumables from I-land. It would sell at prices set in C$ and would handle the physical distribution. I am concerned about the accounting implications of having a foreign subsidiary and its impact on the overall group figures. If we proceed we will buy 100% of the equity for cash and we will fix selling prices in C$.

Could you do two things for me?

First of all, explain the issues associated with a potential franchisee conducting an analysis around key sensitive variables. How might we address the possibility that our franchise development staff in C-land might be demotivated by such concerns when attempting to find potential franchisees?

Secondly, could you use your knowledge of accounting to help me to identify the impact of currency movements on Pizzatime's consolidated financial statements if we buy a local logistics company and the C$ weakens?"

CIMA G1 Summary

- Vendor: CIMA

- Product: G1

- Update on: Jan 7, 2026

- Questions: 20